Men’s underpants can cost about 28 percent more than women’s knickers. But women’s shampoo can be as much as 48 percent more expensive than a similar product for men.

The difference in price for a broadly similar product just because it is geared at either men or women is worth examining in detail for online sellers looking to source products that generate higher resale margins. Why sell men’s razor cartridges when women’s razor cartridges retail for almost 11 percent more? The item has an almost identical product specification apart from the fact that it might be pink. This means the same storage, packaging and logistics costs for an item with a lower profit margin.

Nimbly sidestepping all the ethical issues about charging men too much for their jocks or women way too much for jeans, does the so called “pink tax” provide an opportunity for online sellers to review their stock selection based on what the different sexes will pay more for. And perhaps open the door for online sellers to meet market demand by sourcing and selling men’s and women’s products at the exact same price?

The New York City Department of Consumer Affairs (DCA) study found that across 35 product categories, spanning five industries, women pay 7 percent more than men on average. The study focused on products that shared similar characteristics for both genders and looked at average, high and low price alternatives.

Female versions are more expensive

- Shampoo and conditioner up to 48 percent more

- Girl’s toys and accessories cost 7 percent more

- Girl’s clothing cost 4 percent more

- Women pay 8 percent more for adult clothing

- Personal care products cost women 13 percent more

- Senior/Home Health Care Products cost 8 percent more

While the DCA report found that women’s goods were more expensive 42 percent of the time, it also discovered that 18 percent of the time men’s products cost more.

Men’s products that costs more

- Underwear cost an average of 28 percent more for men

- Digestive healthcare products cost men 5 percent more

- Shaving cream costs men on average 4 percent more

- Boy’s toddler shoes 3 percent

Interestingly, for men in the low price range, adult clothing, dress pants, dress shirts and sweaters all cost more.

We decided to check this out and scoured Amazon for examples of the “pink tax”. There were some pretty hefty price differences:

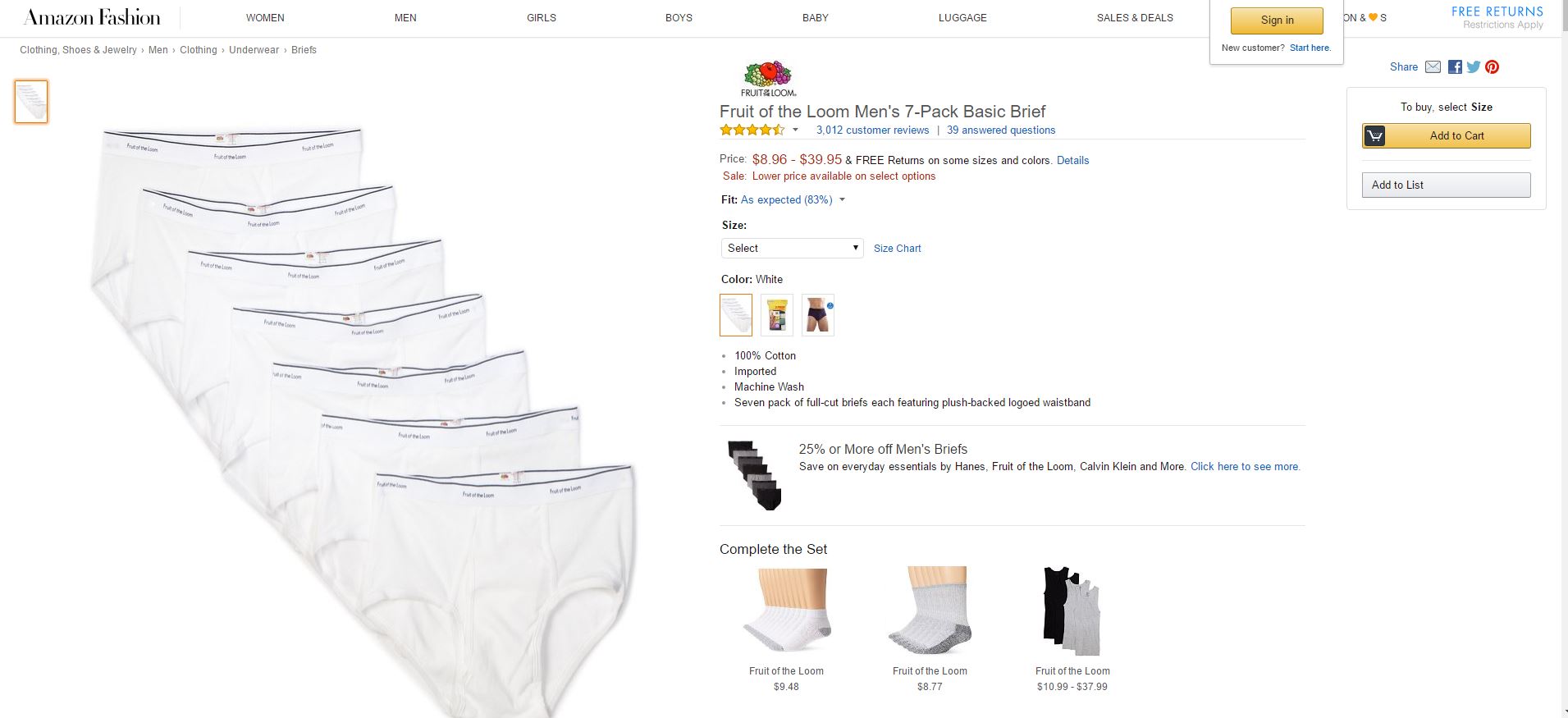

7 Pack of Fruit of the Loom ladies brief for $14.99

7 Pack of men’s Fruit of the Loom underpants $19.18

Men pay up to 28 percent more.

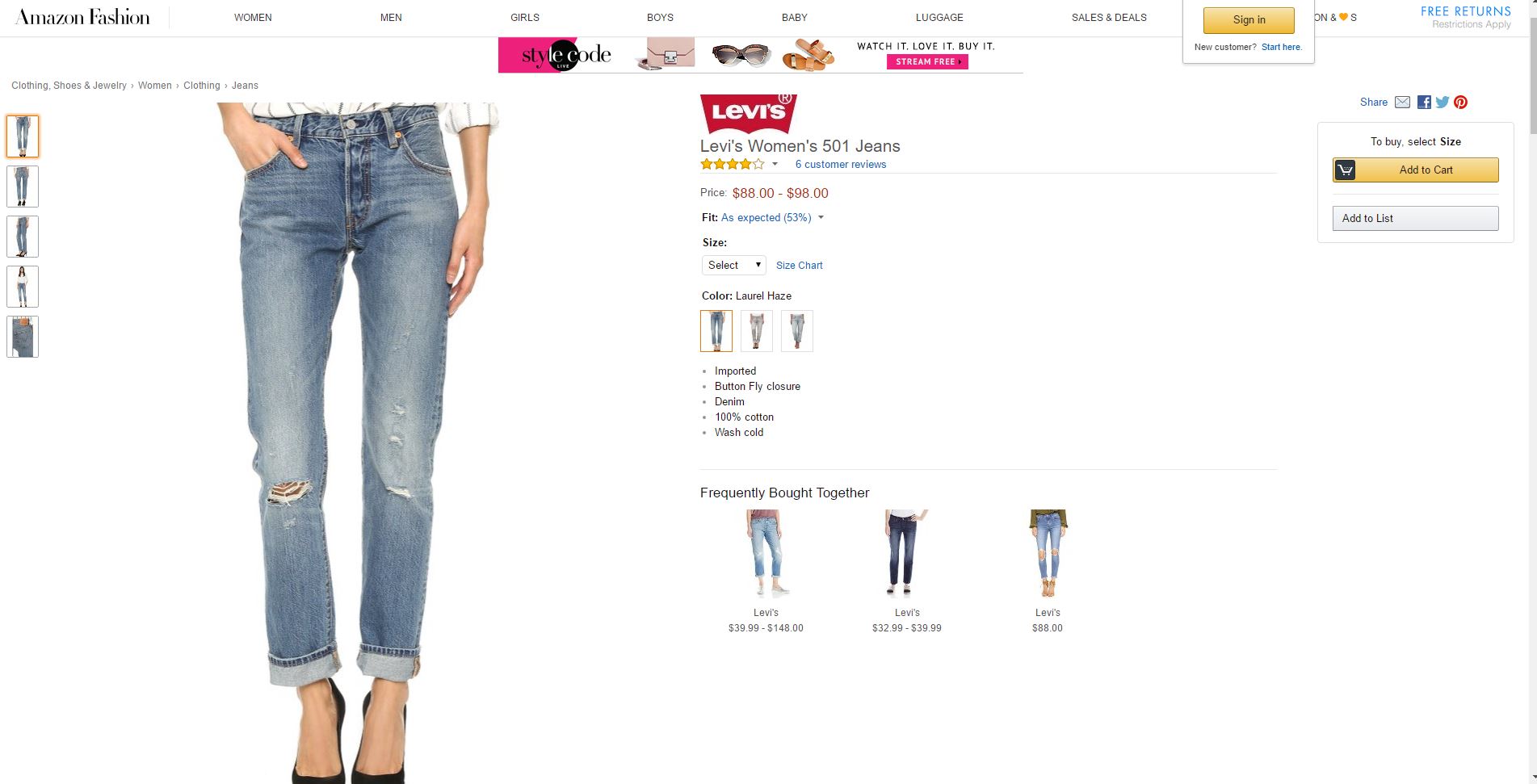

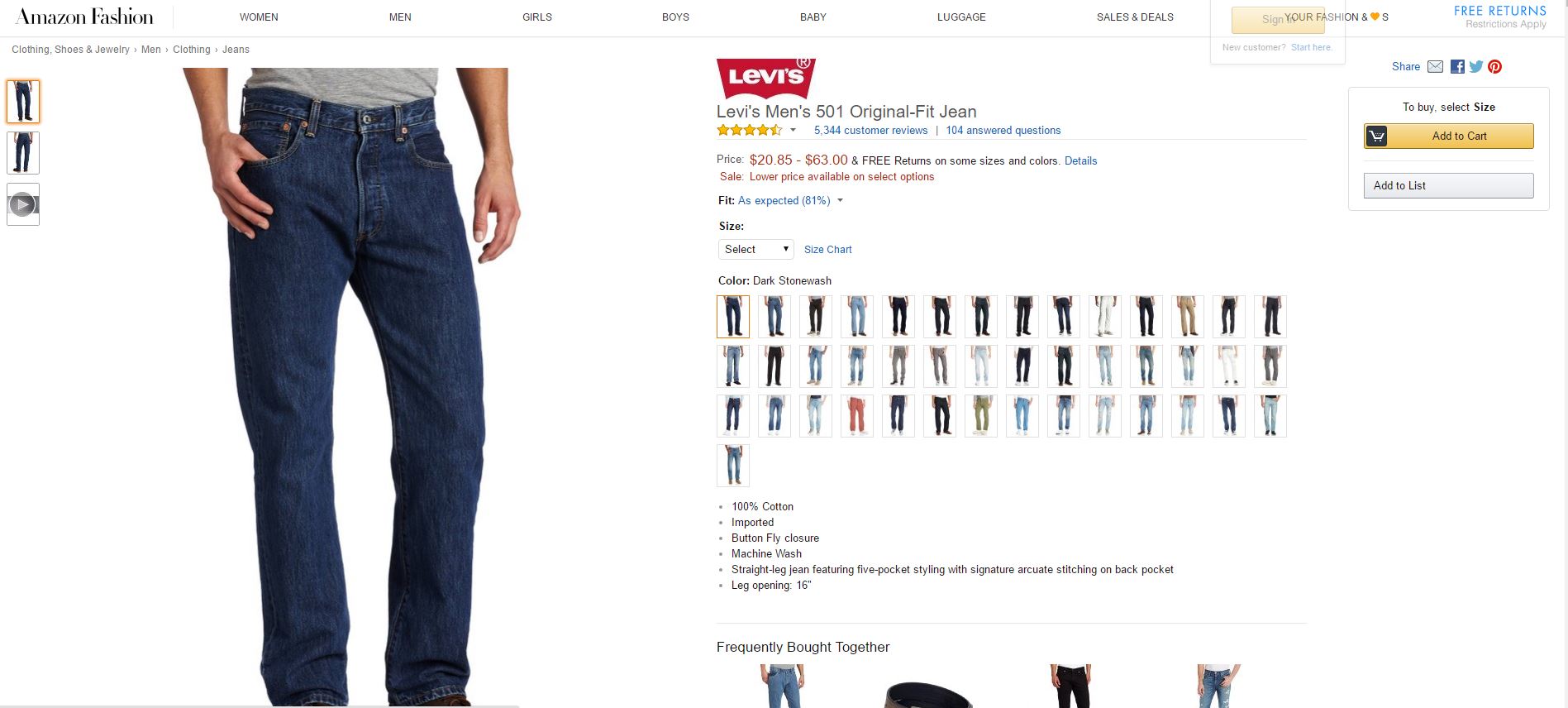

Women’s 501 jeans $88

Men’s 501 jeans $42.99

Women pay up to 104 percent more.

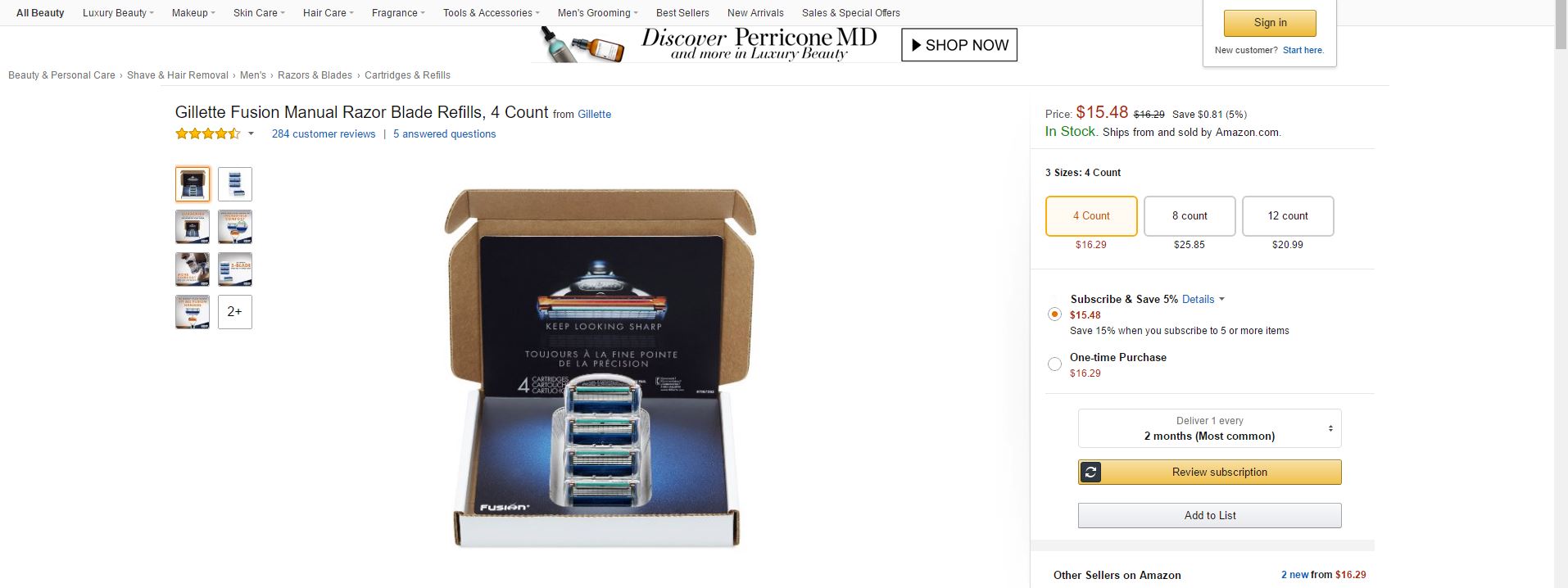

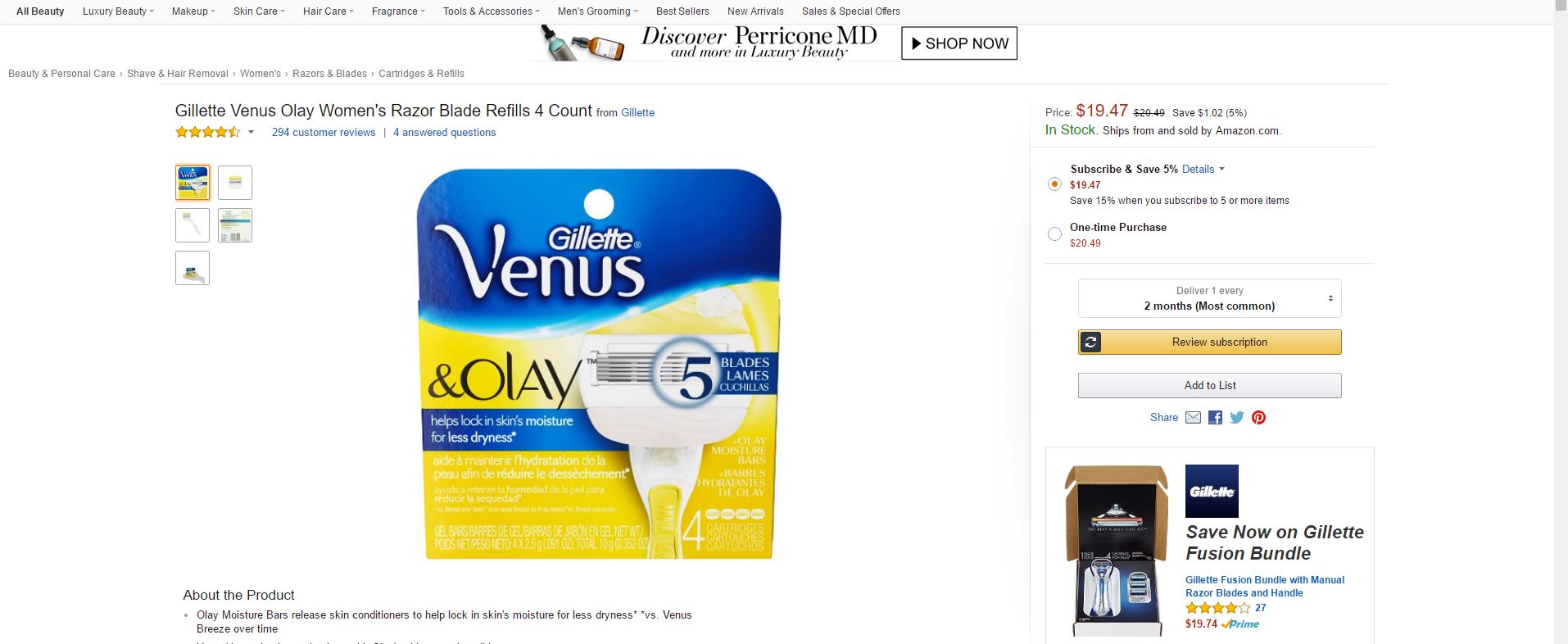

Men’s Gillette Fusion razor cartridge 4 pack $15.48

Women’s Gillette Venus 4 pack $20.49

Women pay up to 32 percent more.

Girl’s Raskullz Unicorn helmet $24.99

Boy’s Raskullz dinosaur helmet $17.99

Girl’s product is 39 percent more expensive.

Some of the differences in cost may be for fairly legitimate reasons such as extra design features. But pink dye can’t be that much more expensive, so in most cases women are paying far more. The report concludes that gender-based price inequality is ‘inescapable’ based on retailers’ choices and the product offerings ‘available’ to women.

Where are the opportunities?

According to IbisWorld research, men’s clothing is the fastest growing online category over the past five years, with average annual sales growth of 17.4 percent, shoes, healthcare and cosmetics also feature prominently. Women’s clothing on Amazon Prime was one of the few categories to grow over the last 12 months, increasing from 9.9 percent to 11.2 percent. The market for gender specific items isn’t yet saturated, unlike cameras and camcorders, for example.

So, despite gender-based pricing, both men and women still want to buy feminine and masculine versions of products but they are increasingly looking for better value. Based on the unit costs for storage, packaging and delivery, it may be less economic to sell products like men’s shampoo, it seems clear that some online sellers can make chunky profits from other items.

Either there’s a huge gap in the market for someone who can sell women’s products for the exact same price as men’s, or else to keep making higher margins by stocking gender-specific products at higher prices until consumer habits change.