It’s safe to say 2015 was a good year for Amazon.

Becoming the fastest company ever to reach $100 billion in annual sales is a nice prize to add to your trophy cabinet. Amazon AWS isn’t shaping up too badly either – reaching $10billion in sales in a shorter time than its retail arm did.

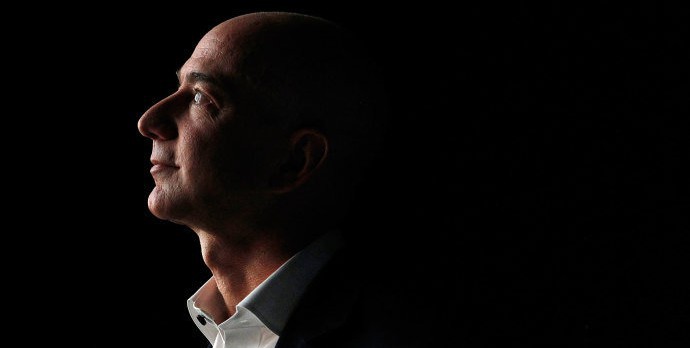

In the midst of all of this success, you would expect a characteristically confident and boastful message from Jeff Bezos to his shareholders. By and large, he delivered.

But the Amazon CEO also took the opportunity to talk about a more surprising topic – failure. It’s not a word we would often associate with the eCommerce giant.

So what is there to learn about Amazon’s ‘failure’? Here are three key points we took from the founder’s letter to shareholders.

3 Things We Learned from Jeff Bezos’s Letter to Amazon Shareholders

1. How Failure Wins… Eventually

Bezos called failure and invention ‘inseparable twins’.

So, without failure we can’t invent.

When we become too focused on succeeding, and reject the idea of failure, we forget one of the key ingredients to success – invention.

To succeed, we must experiment and be willing to take risks.

As Bezos said, “most organizations are willing to embrace the idea of invention, but are not willing to suffer the string of failed experiments to get there”.

Five fails could mean one big success – if you’re willing to lose some cash along the way.

2. Invest in the long view

How does a company with the growth history of Amazon maintain such a flat profit line? Simple – investment.

When Amazon makes money, it throws it straight back into another ambitious project. From Kindle to AWS to Prime to Logistics. Amazon’s commitment to investment in the long term of the company is relentless. It’s also why its investors who want to see returns aren’t always the happiest bunch, despite Amazon’s unquestionable dominance in the eCommerce industry.

Bezos called Marketplace, AWS and Prime the three pillars of Amazon. Some of his biggest bets are now his biggest wins.

He also revealed 70k Amazon sellers making over $100k in sales – making it easy to see why Marketplace is a core aspect of the business.

What does he think will drive Marketplace further? Seller Fulfilled-Prime is his next bet.

The key learning? If you have a choice between a quick win or the long shot that could see big returns, the latter might be the wiser option.

3. Business is like baseball – but better

Bezos made an interesting analogy that baseballs fans will especially enjoy. Read it below.

“We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs. The difference between baseball and business, however, is that

baseball has a truncated outcome distribution. When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in a while when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.”

When you’re not Amazon, bold bets can be a difficult choice. But if the bold bet becomes a key component of your business, you’ve won. Then you either rest on your winnings – or take a leaf from Amazon and go out and bet again.

One note of caution that Bezos did miss – just be aware of how many strikes you’re on!